IT sector adds the most this week, 6%: Aus shares rise for 2nd week, this time adding 1.2%

Four days of straight gains and we are now about four per cent away from the all-time high hit late July.

It was another positive week for the Australian stock market as US markets also bounced back on China saying it won’t retaliate to US president Donald Trump’s revised tariffs on China, with a set of tariffs to kick this weekend.

We’ve also seen global bonds mostly rise overnight, but they are still lower on the week, month and year, which is boding well for real assets including real estate, and the REIT sector, as well as infrastructure.

This week the local IT sector gained the most again for the second straight, gaining 5.8 per cent this week after rising 7 per cent last week.

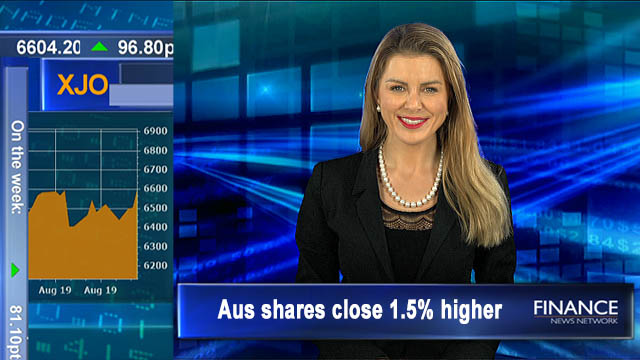

At the closing bell the S&P/ASX 200 index closed 97 points up or 1.5 per cent to finish at 6,604. Over the week, the market has gained 1.2 per cent or 81 points. Last week the market gained 118 points or 1.8 per cent higher.

Futures market

Dow futures are suggesting a rise of 1 points.

S&P 500 futures are eyeing a dip of 4 points.

The Nasdaq futures are eyeing a fallift of 19 points.

And the ASX200 futures are eyeing a 1.3 per cent rise.

Economic news

The total number of dwellings approved in Australia fell by 3.2 per cent in July 2019 in trend terms, according to data released by the Australian Bureau of Statistics (ABS). The seasonally adjusted estimate for total dwellings approved fell 9.7 per cent in July, a massive fall compared to flat result expected.

Company news

Global ship building company, Austal Ltd (ASX:ASB) shares jumped 14 per cent higher today on the company reporting record FY2019 revenue and profit with NPAT of $61.4 million, a rise of up 64 per cent, compared to the same time last year, while revenue jumped 33 per cent to $1.852 billion with growth across all key areas of the business, including from its US Navy programs, commercial vessels, and increased support work. The business also entered FY2020 with an order book of $4.9 billion. ASB has 7 shipyards service centres in 5 countries and its shares closed at $4.22 today. Year on year its shares have gained 139 per cent.

Resolute Mining (ASX:RSG) reported its attributable half year net profit after tax rose 9 per cent to $36 million in the period ending 30 June 2019. Revenue rose 33 per cent to $324 million.

Harvey Norman Holdings (ASX:HVN) has seen its net profit after tax a for the year ended 30 June 2019 rise 8.4 per cent to $574.6 million. It reported record offshore retail revenue of $2.05 billion and record offshore retail profit of $129.70 million.

BlueScope Steel (ASX:BSL) informed the ASX today that the ACCC (Australian Competition and Consumer Commission) kicked off civil proceedings against the company and its former employee Jason Ellis for allegedly contraventions Australian competition law cartel provisions. The proceedings relate to conduct that allegedly involve Mr Ellis, during the period September 2013 to June 2014, attempting to induce various steel distributors in Australia and overseas manufacturers to enter agreements containing a price fixing provision.

IPOs

MRI-guided cardiac catheter company, Imricor Medical Systems, Inc. (ASX:IMR) started trading today. It issued shares at $0.83 and started trading on the ASX at $1.30 and is currently trading at $1.45

Best and worst performers of the day

The best performing sector was S&P/ASX Consumer Staples adding 1.8 per cent while the worst performing sector was S&P/ASX Consumer Discretionary, adding 0.3 per cent.

The best performing stock in the S&P/ASX 200 was Austal Limited (ASX:ASB), rising 14.4 per cent to close at $4.22. Shares in Appen Limited (ASX:APX) and Eclipx Group (ASX:ECX) followed higher.

The worst performing stock in the S&P/ASX 200 was Harvey Norman Holdings Limited (ASX:HVN), dropping 6.2 per cent to close at $4.38. Shares in Corporate Travel Management Limited (ASX:CTD) and Boral (ASX:BLD) followed lower.

Asian markets

Japan’s Nikkei has added 1.2 per cent, Hong Kong’s Hang Seng has gained 0.5 per cent and the Shanghai Composite has added 0.3 per cent.

Wall Street

Over the four trading days in the US, Dow Jones 2.8 per cent, S&P 500 rose 2.6 per and the Nasdaq lifted the most, 3.1 per cent.

Commodities and the dollar

Gold is trading at SS$1,532 an ounce.

Iron ore price fell 1.2 per cent to US$81.47

Iron ore futures are pointing to a rise of 2.1 per cent.

Light crude is US$0.83 up at US$56.61 a barrel.

One Australian dollar is buying 67.12 US cents.

Copyright 2019 – Finance News Network

Source: Finance News Network