Engineering construction work fell in the June quarter: ASX closed 0.6% lower

The Australian share market slipped at the open and failed to pull itself back up closing 0.6 per cent lower. Beach Energy (ASX:BPT) and Pro Medicus (ASX:PME) pulled on the market dropping over 5 per cent. Meanwhile, Afterpay Touch (ASX:APT) shares rose after giving an interim report to AUSTRAC. More on this later. Retail Food Group (ASX:RFG) shares fell after reports they are meeting with investors in relation to a potential equity raising.As for the sectors, Infotech led the pack with Energy trailing behind.

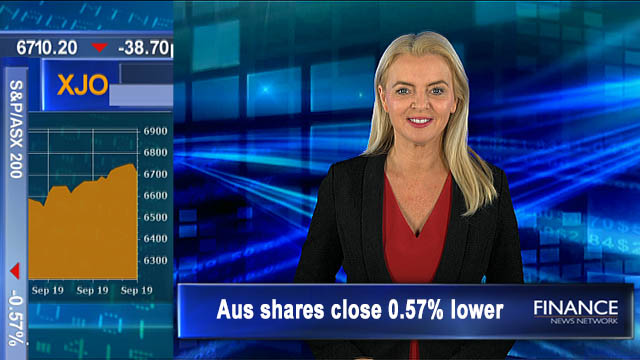

The S&P/ASX200 index

At the closing bell the S&P/ASX 200 index closed39 points lower to finish at 6,710.

Futures market

Dow futures are suggesting a rise of 36 points.

S&P 500 futures are eyeing a rise of 4 points.

The Nasdaq futures are eyeing alift of 7 points.

And the ASX200 futures are eyeing a 43 point fall tomorrow morning.

Economic news

The trend estimate for the value of total engineering construction work done fell 2.9% in the June 2019 quarter.The seasonally adjusted estimate for the value of total engineering construction work done fell 0.9% in the June quarter .

Company news

BINGO Industries (ASX:BIN) has agreed to sell its Banksmeadow facility to CPE Capital for $50 million. CPE Capital used to be known as CHAMP Private Equity.The Australian Competition and Consumer Commission (ACCC) has approved CPE as the purchaser. BINGO expects to complete the sale before 9 October 2019. Shares in BINGO Industries (ASX:BIN) closed 4.4 per cent lower at $2.15.

AGL Energy (ASX:AGL) has entered into a Gas Supply Agreement with Esso Australia Resources for the purchase of a total of 50 petajoules of gas. The agreement will start in 1 January 2021 and finish on 31 December 2022 and support AGL’s continued supply of its gas customers.

Animal nutrition supplier Ridley Corporation (ASX:RIC) is to close its Murray Bridge feedmill in South Australia next month. The annualised cash drain on Ridley is in the vicinity of $1.5 million. Employees have been offered alternative employment wherever possible within Ridley.

The Afterpay Touch Group (ASX:APT) has updated the market in relation to their Anti-Money Laundering and Counter-Terrorism Financing Act matters. The confidential interim report of external auditor Neil Jeans has now been provided to AUSTRAC without any recommendations, this will be left to the final report. Afterpay has not identified any money laundering or terrorism financing activity via our systems to date.

WiseTech Global (ASX:WTC) released their annual report today showing significant revenue growth for Financial year 2019 up 57 per cent to $348.3 million from last year's $221.6 million. Net profit after tax increased 33 per cent to $54.1 million from last year's $40.million.

Best and worst performers

The best performing sector was Infotech adding 1 per cent while the worst performing sector was Energy, shedding 1.6 per cent.

The best performing stock in the S&P/ASX 200 was Afterpay Touch Group (ASX:APT) rising 13.3 per cent to close at $36. Shares in Bravura Solutions (ASX:BVS) and Smartgroup Corporation (ASX:SIQ) followed higher.

The worst performing stock in the S&P/ASX 200 was Pro Medicus (ASX:PME),dropping 5.8 per cent to close at $28.08. Shares in Beach Energy (ASX:BPT) and Jumbo Interactive (ASX:JIN) followed lower.

Asian markets

Japan’s Nikkei has lost 0.4per cent, Hong Kong’s Hang Seng has lost 1.2 per cent and the Shanghai Composite has lost 0.7 per cent.

Commodities and the dollar

Gold is trading at US$1,528 an ounce.

Iron ore price fell 3.5 per cent to US$90.83

Iron ore futures are pointing to a fall of 1.8 per cent.

Light crude is US$1.27 lower at US$56.82a barrel.

One Australian dollar is buying 67.78 US cents.

Copyright 2019 – Finance News Network

Source: Finance News Network