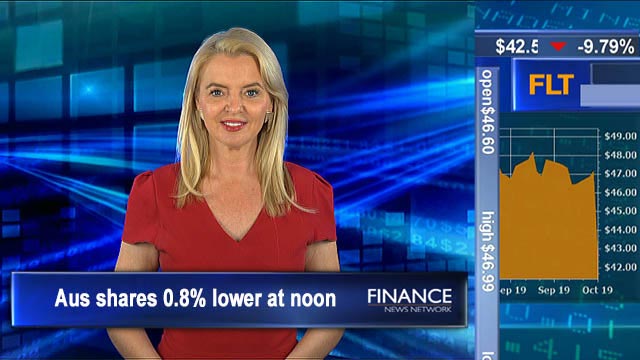

Flight Centre shares fall on challenging H1 predictions: ASX 0.8% lower at noon

The Australian share market opened lower following soft leads from Wall Street and is now tracking 0.8 per cent lower at noon. Cleanaway Waste Management (ASX:CWY) shares shot up after becoming the successful bidder for the acquisition of the assets of the SKM Recycling Group. Flight Centre Travel Group (ASX:FLT) saw their shares drop almost 10 per cent this morning after they released their likely outcomes for financial year 2020 patterns. Clinuvel Pharmaceuticals (ASX:CUV) shares are continuing the rise this week after the announcement they have received FDA approval for Scenesse for a rare genetic metabolic disorder. All the sectors are in the red today – the Industrials sector is top of the bottom pile and the Energy sector trailing behind after the first two hours of trade.

The S&P/ASX 200 index is 51 points down at 6,543. On the futures market the SPI is 0.7 per cent points lower.

Local economic news

The Westpac-Melbourne Institute Index of Consumer Sentiment fell 5.5% to 92.8 in October from 98.2 in September. This is the lowest level of the Index since July 2015. The Index has fallen by 8.4% since the Reserve Bank started cutting rates in June and is down by 8.6% over the last year.

Company news

Flight Centre (ASX:FLT) reported today that their first-half underlying profit would be below the figure from same corresponding period a year ago. Managing director Graham Turner says the company has not yet seen benefits flowing from recent interest rate cuts and tax refunds and that any benefits were more likely to be seen later in financial year 2020. The firm will take $7 million costs after the collapse of British travel company Thomas Cook, associated with reaccommodating customers. During financial year 2019, the company delivered a $343.1 million underlying profit before tax. Shares in Flight Centre (ASX:FLT) are currently trading 9.8 per cent lower at $42.58.

Regenerative medicine company Orthocell (ASX:OCC) has seen positive interim clinical results for the use of CelGro® for enhancing repair of peripheral nerves. Following surgery with CelGro®, patients have regained muscle function in the affected parts of the body and have either stopped or reduced prescription pain medication. Patients participating in the clinical trial had previously suffered traumatic nerve injuries following motor vehicle, sport or work-related incidents, resulting in impaired use of some limbs and in some cases quadriplegia. Shares in Orthocell (ASX:OCC) are currently trading 21.5 per cent higher at $0.48

Zelda Therapeutics (ASX:ZLD) is looking to merge with with Ilera Therapeutics. Illera is a privately held medicinal cannabis and cannabinoid science company based in the United States. Illera has a partnership with Canadian group Ethicann Pharmaceuticals Inc. to develop a proprietary product, CAN-001, to treat chemotherapy-induced nausea and vomiting. Shares in Zelda Therapeutics (ASX:ZLD) are trading 3.9 per cent higher at $0.08.

Best and worst performers

The best-performing sector is Industrials, losing the least at 0.08 per cent, while the worst performing sector is Energy, shedding 1.5 per cent.

The best performing stock in the S&P/ASX 200 is Clinuvel Pharmaceuticals (ASX:CUV), rising 39.3 per cent to $39.13, followed by shares in Saracen Mineral Holdings (ASX:SAR) and Cleanaway Waste Management (ASX:CWY).

The worst performing stock in the S&P/ASX 200 is Flight Centre Travel Group (ASX:FLT), dropping 9.8 per cent to $42.58, followed by shares in News Corp (ASX:NWS) and AMP (ASX:AMP).

Commodities and the dollar

Gold is trading at US$1,505 an ounce.

Iron ore price rose 1.5 per cent to US$94.77

Iron ore futures are pointing to a fall of 0.3 per cent.

One Australian dollar is buying 67.34 US cents.

Copyright 2019 – Finance News Network

Source: Finance News Network