Metcash’s (ASX:MTS) acquisition of Total Tools not opposed

The ACCC will not oppose Metcash’s (ASX:MTS) acquisition of a 70 per cent majority interest in Total Tools Holdings, the franchisor of the Total Tools network.

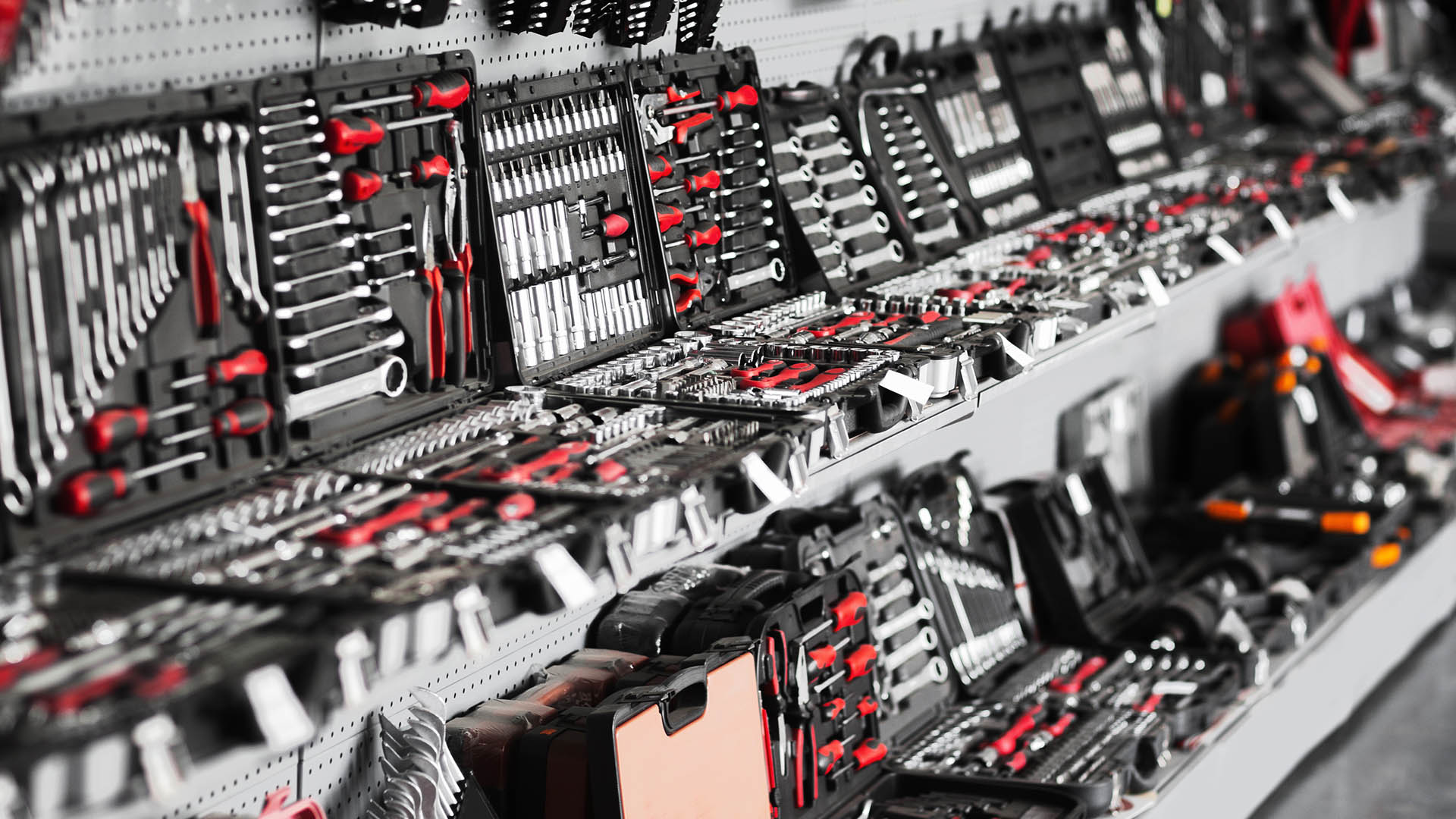

Metcash is a wholesaler and retailer of hardware and home improvement products through its Independent Hardware Group (IHG) division.

IHG’s retail stores include Mitre 10, Home Timber & Hardware, Thrifty-Link Hardware, True Value Hardware and Hardings.

The ACCC considers that IHG stores compete more closely with multi-category hardware stores, such as Bunnings, while Total Tools competes more closely with other tool specialists such as Sydney Tools, as well as Bunnings.

The ACCC concluded that the proposed acquisition was unlikely to result in any vertical competition issues of concern.

Shares in Metcash (ASX:MTS) are trading 2.36 per cent lower at $2.89.

Copyright 2020 – Finance News Network

Source: Finance News Network